Human Services to Support Rural Health

Human services play an important role in ensuring that rural residents and families have resources to maintain or improve their own health. The availability of safe and affordable housing, income supports, food assistance, job training, childcare support, and other services help low-income rural residents take care of themselves so they can stay healthy. When faced with health challenges, people whose basic needs are met are better able to concentrate on recovery and take steps to avoid future problems. Some rural hospitals even employ their own social services staff, in an effort to provide patients with needed services that may help them avoid readmission.

By implementing population health strategies and addressing the social determinants of health (SDOH) through the provision of human services, communities may be able to reduce healthcare costs and develop a more efficient healthcare system. Focusing on preventive care and ensuring that patients who use the healthcare system frequently, such as those with chronic conditions, have their basic needs met may lessen the stressors that contribute to their chronic conditions, decrease the amount of healthcare resources they require, and reduce hospital readmissions. See Social Determinants of Health for Rural People for more information on how SDOH can impact health.

Rural healthcare providers and facilities can help patients find services to meet their basic needs by recommending benefit programs, providing referrals, or coordinating services with human services providers. Likewise, rural human services providers may find that working with healthcare providers is an effective way to identify unaddressed needs. Connecting human services to healthcare can help make limited resources go further and leverage the close-knit nature of rural communities.

This guide focuses on human services that affect healthcare, including:

- Income supports like Temporary Assistance to Needy Families (TANF) and Earned Income Tax Credits (EITC)

- Weatherization and energy assistance

- Housing supports

- Job training and placement

- Childcare assistance

- Child welfare programs

- Home visitation programs for parents and children

Access to healthy food and transportation also impacts health. These issues are covered separately in our other topic guides:

Frequently Asked Questions

- How does the availability of human services affect rural residents' health?

- How does the need for assistance programs compare in rural America?

- Is there representation for rural human services interests at the federal level?

- What rural housing, energy assistance, and weatherization programs are available?

- How do income assistance programs help rural low-income residents and families?

- What job training programs are available in rural communities?

- What support is available to rural families who need child care?

- How are the challenges of addressing child welfare different in rural communities?

- How do human services programs interact with the healthcare system?

- How is the provision of human services different in rural areas?

- What are benefits to the rural healthcare system of helping address the social determinants of health through the provision of human services?

- How can rural healthcare providers help their patients access needed social supports? What programs have been designed to do this?

- How can rural human service providers work with the healthcare system to address patients' basic needs?

- What types of funding are available for coordinating with human services and providing human services benefit enrollment in a healthcare setting?

- What are some of the barriers to integrating human services with healthcare in a rural setting?

- Where can I find information about the different ways human services can be integrated within a rural healthcare organization?

- What human services may be available to rural residents who are affected by the opioid crisis?

How does the availability of human services affect rural residents' health?

Human services can play an important role in the lives of low-income rural residents. People who have access to the fundamental building blocks of well-being that we all need to thrive — access to food, housing, child care, employment, and more — are more likely to improve their well-being by reducing stress and allowing for more time and resources to care for their own health and the health of their families. Unfortunately, many rural communities lack access to adequate human services for their residents. According to the Administration for Children and Families document, Human Services in Rural Contexts Comprehensive Report:

“Rural communities have many assets such as strong community ties and relationships that include nonprofit organizations, faith-based groups, and multiple generations of families living in proximity to one another. However, some rural communities struggle with access to employment opportunities, housing, transportation, broadband internet, and health and human services.”

The absence of these services can make it difficult for rural residents to attend healthcare appointments, communicate with their providers, and mitigate the social determinants of health (SDOH) that can cause health problems.

How does the need for assistance programs compare in rural America?

According to the USDA Economic Research Service's Rural Poverty & Well-Being, the 2019 poverty rate was higher in nonmetro areas (15.4%) compared to metro areas (11.9%) and in some regions, like the South, nonmetro poverty was as high as 19.7%. There are disparities in childhood poverty as well, with 21.1% of nonmetro children considered poor, compared to 16.1% of children in metro areas. To learn more about the impacts of poverty on the health of rural communities, see How do poverty and unemployment impact health in rural communities? on the Social Determinants of Health for Rural People topic guide.

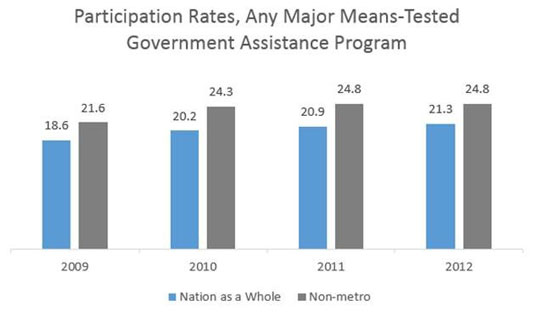

According to a May 2015 U.S. Census Bureau report, Dynamics of Economic Well-Being: Participation in Government Programs, 2009–2012: Who Gets Assistance?, nonmetropolitan participation in six national assistance programs is higher than for the nation as a whole. The six major means-tested programs include: Temporary Assistance for Needy Families (TANF), state general assistance programs, Supplemental Security Income (SSI), Supplemental Nutrition Assistance Program (SNAP), Medicaid, and housing assistance.

Rural counties with high populations of Hispanic, Black, and Native American residents are some of the most disadvantaged communities in the country. According to the 2022 brief A Snapshot of Racial Inequities in Human Services Programs in Rural Contexts, average unemployment, poverty, lack of access to broadband, and lack of access to vehicles were all higher in rural counties with people of color than compared to rural counties that were predominantly White. The brief suggests that the availability of human services in these areas is of great need.

Is there representation for rural human services interests at the federal level?

Yes, the National Advisory Committee on Rural Health and Human Services (NACRHHS) is a 21-member committee that acts as an independent advisory group for the Secretary of Health and Human Services in the areas of rural health and human services. NACRHHS also authors reports, recommendations, and policy briefs on various topics and challenges related to the provision of healthcare and human services in rural areas.

What rural housing, energy assistance, and weatherization programs are available?

The U.S. Department of Agriculture (USDA) Rural Development's Rural Housing Service provides direct assistance in the form of loans, grants, and loan guarantees to low-income rural homeowners and renters who are unable to obtain financing from conventional sources. These programs can also assist with the purchase and rehabilitation of single and multi-family homes.

USDA Rural Development single family housing programs:

- Single Family Housing Direct Home Loans – Offers loans to help low-income applicants purchase, build, repair, renovate, or relocate safe and sanitary homes in eligible rural areas.

- Single Family Home Loan Guarantees – Provides loan guarantees to low- and moderate-income households to purchase, build, rehabilitate, improve, or relocate a structure in an eligible rural area with 100% financing.

- Mutual Self-Help Housing Technical Assistance Grants – Offers grants to eligible organizations to supervise and provide technical assistance to low-income families as they construct their own homes in rural areas.

- Rural Housing Site Loans – Provides loans to eligible applicants to acquire and build homes for low- and moderate-income families.

- Single Family Housing Repair Loans and Grants – Provides loans to low-income homeowners to repair, improve, or modernize their homes. Also offers grants to low-income elderly homeowners to remove health and safety hazards.

USDA Rural Development multi-family housing programs:

- Farm Labor Direct Loans & Grants – Offers financing to build housing for migrant or seasonal domestic farm laborers.

- Rural Multifamily Preservation and Revitalization Program – Restructures loans for existing rural rental housing and off-farm labor housing projects to improve safe and affordable rental housing for low-income residents.

- Housing Preservation Grants – Provides grants to organizations to help low-income rural residents repair or rehabilitate housing they own or occupy.

- Multifamily Housing Direct Loans – Offers competitive financing options for multi-family rental housing units for low-income, elderly, or disabled individuals and families in eligible rural areas.

- Multifamily Housing Loan Guarantees – Seeks to increase the number of affordable rental housing units for low- and moderate-income individuals and families living in eligible rural areas by offering financing options to qualified private-sector lenders and qualified borrowers.

- Multi-Family Housing Rental Assistance Program – Provides payments to owners of USDA-financed rural rental housing or farm labor housing programs on behalf of tenants. This program is also available for low-income rural residents.

The U.S. Department of Housing and Urban Development (HUD) offers several programs intended to help individuals and rural communities access affordable and safe housing that are generally accessed through state, local, and community partners, including:

- Community Development Block Grant Programs (CDBG)

- Indian Community Development Block Grant Program (ICDBG)

- Indian Housing Block Grant Program (IHBG) and Indian Housing Block Grant – Competitive Grant Program

- Hope VI Main Street Program

- Tribal Housing Activities Loan Guarantee Program (Title VI)

Other helpful tools and services for those looking for assistance and information on rural housing include the HUD Exchange Rural Gateway and HUD rental assistance program. Affordable Housing and Recovery in Rural Communities provides information on rural housing options for those with substance use disorder (SUD) and/or criminal charges.

The Housing Assistance Council (HAC) is a national organization that helps local groups build affordable homes for low-income residents in rural communities. HAC offers low-interest loans and technical assistance, training, and programs for veterans and other vulnerable populations in rural areas.

The Low Income Home Energy Assistance Program (LIHEAP), offered through the U.S. Department of Health and Human Services, primarily focuses on providing federal financial assistance to qualifying individuals and families with low incomes to help pay their energy bills. LIHEAP can also help with home weatherization and minor energy-related home repairs to reduce energy consumption.

The Weatherization Assistance Program from the U.S. Department of Energy helps low-income families permanently reduce their energy bills by making homes more energy efficient through repairs and weatherproofing.

HUD's Healthy Homes Program works to protect the health of children and families by addressing home environmental health concerns including mold, lead, allergens, asthma, carbon monoxide, pesticides, and radon. Healthy Homes grants are available to organizations, state and local governments, federally-recognized Indian tribes, and colleges and universities. These grants can be used to develop effective hazard intervention methods and provide public education to decrease housing-related environmental safety problems.

In some states, rural utility cooperatives may offer utility-funded bill assistance programs. Other low- and moderate-income energy efficiency programs, financed by states or utility providers to assist with weatherization, may also be available.

To learn more about the impacts of rural quality housing on health, see How does the quality of housing available in rural areas impact people's health? on the Social Determinants of Health for Rural People topic guide.

How do income assistance programs help rural low-income residents and families?

The Earned Income Tax Credit (EITC) provides a refundable tax credit for many low- to moderate-income working individuals and families. The benefit amount depends on the recipient's income, number of children, number of dependents, and other criteria. The article Earned Income Tax Credit Plays Outsized Role in Rural reports that a higher percentage of noncore rural taxpayers (23.4%) received EITC payments compared with metropolitan taxpayers (19.8%).

Temporary Assistance to Needy Families (TANF) and Tribal Temporary Assistance for Needy Families (Tribal TANF) are another type of federal income assistance that provides time-limited financial assistance and employment and training services to low-income families. TANF benefits are funded through block grants to states and federally recognized American Indian tribes and administered locally through county human services agencies. States and tribes have some flexibility in how they implement the program. The Carsey School of Public Policy report, TANF in Rural America: Informing Re-Authorization, compares differences in TANF participation rates in rural and urban areas, and found that, in 2009, over 11% of rural low-income families received TANF benefits compared with almost 14% of urban low-income families. The smaller percentage of low-income rural families using TANF could be due to barriers accessing human services and stigma connected with receiving government assistance in rural communities.

The U.S. Department of Labor provides oversight for the unemployment insurance programs that operate in all 50 states and some territories. Unemployment insurance provides benefits to eligible workers who find themselves unemployed by no fault of their own and meet specific eligibility requirements. Some states may have additional criteria determined by state law.

Healthcare providers can help patients access assistance programs by directing them to local human services agencies or other online resources such as the EveryONE Project: Neighborhood Navigator tool from the American Academy of Family Physicians. Benefits.gov also provides information and links to federal and state benefit programs, including TANF, Tribal TANF, state general assistance programs, Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), unemployment benefits, and other programs that can help rural low-income families.

What job training programs are available in rural communities?

Job training programs can help workers develop and improve their skills and abilities to obtain and keep steady employment. Workforce Development Boards are a network of federal, state, and local offices that support workers and employers. Local Workforce Development Boards support regional planning efforts to address local workforce needs and oversee the American Job Centers, one-stop shops offering services and assistance for jobseekers, with funding from the U.S. Department of Labor and oversight from the state workforce agency.

A few examples of resources and services for rural jobseekers include:

- The Northern Rural Training and Employment Consortium (NoRTEC) in Northern California is an example of a workforce program that provides job training and employment services to build a strong rural workforce and support the rural economic prosperity.

- The National Farmworker Jobs Program (NFJP) helps migrant and seasonal farmworkers and their families access education, job training, housing, and child care. The federal program partners with state and community organizations to help workers enter the workforce and obtain employment that suits their skill set.

- Native Employment Works Program (NEW) provides funds to federally recognized Indian Tribes and Alaska Native organizations to offer education and training to support job readiness, placement, and retention for tribal populations and service areas.

- There are other initiatives that support rural residents in search of work, such as the Rural Workforce Innovation Network (RWIN). RWIN seeks to build partnerships and collaboration to improve workforce opportunities for rural jobseekers.

Other programs that can provide support and services to help rural residents finding employment and job training include:

- SNAP Employment and Training services.

- State and territorial vocational rehabilitation agencies.

- TANF recipients can also receive support for basic education, job training, job placement, technical training, and other services related to child care and transportation as it relates to finding and obtaining employment.

What support is available to rural families who need child care?

Rural jobseekers with families often face their own challenges related to finding childcare accommodations. An October 2020 Bipartisan Policy Center report, Child Care in 25 States: What We Know and Don't Know, analyzed the supply and demand of child care in 25 states to identify trends and gaps in care based on geographic and socioeconomic factors prior to the start of the COVID-19 pandemic. The analysis found that 17 of the 25 states had a larger childcare gap in rural areas compared to urban areas. The study also found that only 38% of families living in rural areas reported that finding quality child care within their budget was easy, while over 50% of families living urban areas reported the same. According to the January 2023 policy brief Childcare Need and Availability in Rural Areas, childcare deserts are more common in census tracts in rural areas. The Center for American Progress reports that nearly 60% of rural areas are in childcare deserts.

The Child Care and Development Fund (CCDF), authorized by the 2014 Child Care and Development Block Grant Act (CCDBG), is a partnership between the federal government and states to provide financial assistance to help families with low income access quality child care so they can work, attend school, or obtain job training. CCDF is administered by states and tribes with support from the Administration for Children & Families (ACF) Office of Child Care. A 2017 report from the Center for Law and Social Policy (CLASP) and the National Women's Law Center (NWLC), Implementing the Child Care and Development Block Grant Reauthorization: A Guide for States, analyzes the CCDBG and offers implementation considerations for states aimed at increasing the availability and quality of childcare providers for targeted populations, including those living in rural areas.

The U.S. Child Care Deserts Mapping Tool, from the Center for American Progress, is an interactive map illustrating the demand and supply for child care as well as the locations of childcare deserts. Due to the difficulty of finding quality child care that is also affordable, many residents rely on informal arrangements with family, friends, or other caregivers, who might or might not be licensed childcare providers. Childcare.gov offers information and considerations when searching for quality child care. Head Start and Early Head Start are federally-funded programs that promote early childhood education and development for children 5 and younger from families with low income, including those located in rural areas.

How are the challenges of addressing child welfare different in rural communities?

Child Abuse and Maltreatment

A January 2021 Children and Youth Service Review journal article, Rural Differences in Child Maltreatment Reports, Reporters, and Service Responses, examines urban and rural differences in child maltreatment reporting by both professional and nonprofessional reporters from 2003 to 2007 and 2013 to 2017. The study found reporting rates highest in rural areas for both professional and nonprofessional reporters and that rural areas were more likely to have re-reports of child maltreatment compared to urban areas.

| 2003 to 2007 | 2013 to 2017 | |||||

|---|---|---|---|---|---|---|

| Reporting Source | Rural | Small Urban | Large Urban | Rural | Small Urban | Large Urban |

| Professional | 26.49 | 21.77 | 22.28 | 35.59 | 29.32 | 26.48 |

| Nonprofessional | 29.98 | 19.58 | 16.67 | 29.24 | 20.50 | 15.97 |

| Total | 52.85 | 38.36 | 36.74 | 60.21 | 46.58 | 39.83 |

| Source: Maguire-Jack, K. and Kim, H. 2021. Rural Differences in Child Maltreatment Reports, Reporters, and Service Responses. Children and Youth Services Review, 120. | ||||||

A 2018 Child Welfare Information Gateway issue brief, Rural Child Welfare Practice, shares information on the needs of rural children and families and other factors to consider for those professionals working to improve the welfare of rural children. The brief highlights poverty, child poverty, education, employment, substance use, trauma, transportation, geographic isolation, and limited phone and broadband access as challenges to providing child welfare services in rural communities. For more information on child abuse and neglect in rural areas, see How does child abuse and neglect in rural communities compare to cases in urban areas? on the Violence and Abuse in Rural America topic guide.

A 2018 National Advisory Committee on Rural Health and Human Services (NACRHHS) policy brief, Exploring the Rural Context for Adverse Childhood Experiences (ACEs), outlines programs from numerous federal government agencies that aim to prevent and respond to ACEs in rural communities. In the brief, the committee raises concerns about whether block-grant funds for states sufficiently reach communities with high needs but low populations. For more information on how ACEs may affect the health of rural populations, see What are adverse childhood experiences (ACEs) and how might they affect the health of rural people? on the Violence and Abuse in Rural America topic guide.

The National Center on Substance Abuse and Child Welfare's (NCSACW) Plans of Safe Care Learning Modules offers guidance and information for states, tribes, communities, and other stakeholders to develop or improve their systems of care and services available for infants with prenatal substance exposures and their families.

Families who are working with their local human services systems may need additional support to navigate the requirements. The model Parent Partners discusses how rural parents can receive support to have children who were removed from the home safely return. For more information on this program, see the Rural Monitor article Parent Partners Provide Mentoring and Support in Rural Iowa.

Foster Care and Adoption

Finding appropriate foster care in rural areas can be difficult, with the result that some foster children must leave their community for care. All foster parents must be licensed by the state, which requires background checks, tuberculosis testing, home inspections, and training about the child welfare system. Religious organizations, community groups, and county offices can help foster families by providing financial support for background checks and home modifications. Rural Adoptions: A Different Kind of Rural Trust, a Rural Monitor article, shares examples of successful adoption initiatives in rural communities.

The Child Welfare Information Gateway, a service of the Administration for Children and Families, provides rural child welfare resources to help professionals improve children's health and welfare, reduce child abuse and neglect, increase the number of adoptions, and support foster parents.

How do human services programs interact with the healthcare system?

Cooperation between the human service system and the healthcare system is not new, and has been known by many names, including:

- Integrated health and human services

- Wrap-around services

- Community and public health

- Care management

- Community Oriented Primary Care

Integration of services is becoming more accepted, and its importance more generally acknowledged.

The Place-Based Policies and Public Health: The Road to Healthy Rural People and Places, a Rural Policy Research Institute (RUPRI) report, offers a brief history of this approach, from its beginnings in the 1980s. Community Oriented Primary Care (COPC), a term first used in 1987, is a population-based approach to primary care, in which providers took into account determinants of health and ways to promote health. Two reports issued in 2005, one from the National Advisory Committee on Rural Health and Human Services and another from the National Academies, called for improved coordination across health and social services and a consideration of community health issues.

Programs of All Inclusive Care for the Elderly (PACE) is an integrated care model that provides comprehensive healthcare and human services to the elderly who have chronic care needs, with the goal of allowing them to remain in their communities. PACE lessens the administrative burden for elderly adults and their caregivers because the model coordinates all necessary services.

The Federal Office of Rural Health Policy (FORHP) administers the Rural Health Care Services Outreach Grant Program, which promotes community health service collaborations to expand, improve, and sustain healthcare delivery in rural communities. The RUPRI Human Services Panel Report, Stimulating Local Innovation for Rural Health and Human Services Integration: A Critical Review of the ORHP Outreach Grantees, examined programs involving health and human service integration and noted the following characteristics found in integrated health and human service programs in rural areas:

- Integration does not guarantee overall savings. Further, costs and savings may differ among partners.

- Evidence-based approaches to service integration that work well in certain settings may not adapt well to rural settings.

- Communities experiencing demographic changes or new challenges, such as increased drug use, may benefit most from service integration.

- Other key community organizations, such as schools and the courts, can be included in integration initiatives, though they likely will need support and program flexibility.

- Behavioral health integration with primary care was the most common type of service integration, and a natural next step would be prevention programs for at-risk groups.

- If offering a full range of services is not possible, addition of just one new provider, such as a behavioral health specialist, may be sufficient for service integration.

- If patients are treated in their own homes or schools, rural transportation problems may be avoided.

- Reliance on community volunteers can keep costs down but may make it difficult to maintain services.

To learn more about how rural communities can implement programs that integrate health and human services, see our Rural Services Integration Toolkit.

How is the provision of human services different in rural areas?

In many rural communities, residents must travel significant distances to access support programs or may experience other barriers impacting their ability to seek services. Local agencies and community-based organizations may find that in order to publicize their services, they will need to invest time and effort on outreach.

Rural residents may hesitate to ask for help because of a strong tradition of self-reliance and associated stigma. However, integrating human services with the healthcare system in rural communities may benefit from the strength of relationships between local stakeholders and service providers. Providers in small, rural communities may need to offer several different types of services that are available on evenings or weekends to meet the needs of the communities they serve. These strategies can help providers develop a better understanding of people's needs and problems and position themselves better to meet those needs. The RUPRI Human Services Panel report, Rethinking Rural Human Service Delivery in Challenging Times: The Case for Service Integration, describes this aspect of rural places:

“The creativity and resilience of rural people, and the informal networks so prevalent in rural areas would further complement and enhance an integrated services approach… A rural service integration system would allow the flexibility to combine processes that take advantage of these creative local networks, while addressing the unique needs of a changing rural demographic, particularly with the expanded growth of immigrant and aging populations.”

The COVID-19 pandemic caused a shift to increased availability of virtual delivery of many human services. The Office of the Assistant Secretary for Planning and Evaluation (ASPE) published a series of briefs focused on virtual human services delivery that share implementation information and models, lessons learned, and best practices related to virtual human services delivery. The briefs also identify possible barriers and highlight considerations for human services providers working with underserved and rural populations such as access to technology, broadband, and other platforms for service delivery.

How does addressing social determinants of health through the provision of human services benefit the rural healthcare system?

People with chronic health conditions that require extensive healthcare services can experience other challenges that can have a significant impact on their health and may exacerbate their illnesses such as poverty, hunger or a lack of access to healthy food, housing issues, environmental concerns, and more. A healthcare system that coordinates and collaborates with human services programs and community service providers has a greater opportunity to address the social determinants of health (SDOH), which may reduce the need for and overutilization of healthcare services, reduce burdens on healthcare providers, and avoid value-based reimbursement penalties.

The Healthy People 2030 initiative frames SDOH to encompass:

- Economic stability

- Access to quality education for children and adults

- Timely access to quality healthcare services

- Health and safety improvements in neighborhoods and other built environments

- The building of social and community relationships and support mechanisms

In 2008, the Institute for Healthcare Improvement (IHI) advocated for the Triple Aim concept of improving patient experience, improving population health, and reducing per capita costs of healthcare to improve the overall healthcare system in the U.S. Several provisions of the 2010 Affordable Care Act (ACA) focused on healthcare delivery and how providers are paid by federal programs, shifting the traditional payment for healthcare from volume- to value-based care. An example of this shift to value-based care and payment is the rise of Accountable Care Organizations (ACOs). ACOs emphasize sharing accountability between providers and healthcare organizations to achieve the goals of the Triple Aim. ACOs and other value-based programs provide an incentive for members to work together with human services agencies to expand traditional services, improve the patient experience, improve population health, and reduce the cost of care.

A related shift is occurring, from focusing on providing healthcare when people are sick to a more comprehensive population health approach that focuses on the health of communities, preventive care, and the SDOH. To facilitate this approach, the federal government requires nonprofit hospitals to conduct a community health needs assessment (CHNA) every 3 years to retain their tax status. Rural hospitals can benefit from this requirement by identifying the areas of greatest need in their communities and the sources of highest healthcare costs. Hospitals and their communities then must create an implementation strategy which can coordinate with human services to address identified social needs and reduce healthcare costs, while at the same time improving population health. Additional information and resources related to conducting community health needs assessments are available on our Conducting Rural Health Research, Needs Assessment, and Program Evaluation topic guide.

The CDC Community Health Improvement Navigator provides tools and resources to help healthcare, social services, public health, and other community organizations work together to improve community health. Our Social Determinants of Health for Rural People topic guide offers a more detailed overview of the SDOH and resources on the topic.

How can rural healthcare providers help their patients access needed social supports? What programs have been designed to do this?

One way healthcare providers can help patients find social supports is by co-locating healthcare services with social services. Another option is to add a social worker or case manager to the clinic staff to help coordinate and facilitate care to meet patients' needs. Examples of co-locating services in rural areas include:

- In rural Humboldt County, California, a Federally Qualified Health Center (FQHC) is located in the same building as a Family Resource Center. The RUPRI Human Services Panel report, Humboldt County, California: A Promising Model for Rural Human Services Integration for Transformation, describes how the Family Resource Center provides community services such as case management, food distribution, child care, and benefits application assistance to community members in need. The co-located FQHC and Family Resource Center share a front-desk and administrative staff to help ease the transition from medical services to social services.

- Vermont's Blueprint for Health program includes social workers as part of multi-disciplinary community health teams that operate in a medical home framework along with community-led strategies to improve population health. The Blueprint provides for additional administrative payments to support the community health teams. This program works to connect patients with needed services such as benefit applications, housing needs, weatherization and energy assistance, and offers support in cases of domestic and child abuse. The program also helps physicians stay informed about service options available to their patients.

Efforts to better coordinate care are creating a more formalized process to involve social services in the provision of healthcare. Current programs in rural settings include:

- The Northwest Oregon Network (NEON) Pathways Community Hub is a pay-for-outcome model that uses community health workers (CHWs) to connect patients with the appropriate resources to address their health needs. CHWs identify high-risk patients, determine the best pathway for improved health, and educate them about the health and social services available in their community. They also help patients find needed resources. Once the pathway is successfully completed, payment is made to the employing organization.

- NCCARE360 is a statewide network of healthcare and human services organizations and providers that operate on a shared technology platform to better coordinate and collaborate on improving the health of residents in North Carolina. The North Carolina Department of Health and Human Services has created a statewide framework to address the SDOH by investing in services that provide food, housing, transportation, and interpersonal safety.

The Maine Rural Health Research Center's working paper, Integrated Care Management in Rural Communities, provides examples and strategies for implementing integrated care for long-term care services, many of which are funded under Medicaid, and involve coordination or integration with acute care providers under Medicare.

How can rural human service providers work with the healthcare system to address patients' basic needs?

Family or Community Resource Centers are particularly effective in rural communities. These resource centers provide human services to families with low income in inviting and accommodating settings, and may also offer basic healthcare services such as health screenings, preventive care, immunizations, and more. Family or Community Resource Centers provide health and human services to an entire community, thus reducing stigma associated with receiving safety net services for a single individual. As mentioned in a 2015 RUPRI publication, Accountable Care Communities in Rural: Laying the Groundwork in Humboldt County, California, in rural California:

“The decentralized Family Resource Centers are community sites for a number of activities that promote healthy people and healthy communities, including parent education, food and clothing, social services, local health and behavioral health and community meetings. These centers provide a variety of cross-sector services driven by the needs of the community in an approachable manner.”

Another program to address patients' basic needs is the Full-Service Community Schools Program (FSCS). FSCS is a grant program, funded by the Office of Elementary and Secondary Education, that seeks to coordinate, improve, and integrate health and social services to support community development, children, and families, including children at high-poverty rural schools. FSCS supports the development of partnerships between schools and nonprofits, community-based organizations, and other groups with an interest in providing quality education. Additional resources outlining the Full-Service Community Schools Program, how to start a community school, and what local communities and states are doing to support the model are available from the Coalition for Community Schools. The FAQ How do school-based health centers and community schools impact population health in rural areas? on the Rural Schools and Health topic guide further discusses this model.

Our Rural Services Integration Toolkit provides rural-specific resources that include successful, evidence-based program models, and implementation considerations for rural communities seeking to develop a health and human services integration program. Also, the Human Services Value Curve is a toolkit developed by the American Public Human Services Association (APHSA) that may be useful as a reference document for rural agencies and community organizations working to better integrate health and human service systems.

What types of funding are available for coordinating with human services and providing human services benefit enrollment in a healthcare setting?

The Federal Office of Rural Health Policy (FORHP) offers community-based grants that can be used to support and coordinate relationships between the human services providers and the healthcare system to improve access to care and address unique healthcare needs in rural areas. The Rural Health Network Development Program is a grant to support rural providers who work in formal networks to integrate administrative, clinical, technological, and financial functions. The Rural Health Care Services Outreach Grant Program can support a wide range of non-clinical activities that improve health and healthcare in rural communities.

The Funding & Opportunities section of this topic guide offers a list of rural specific funding for human services projects with a healthcare component.

What are some of the barriers to integrating human services with healthcare in a rural setting?

One of the most significant challenges to integrating human services with healthcare is financial sustainability due largely to difficulty billing for services provided by a social worker or other human service provider in a fee-for-service healthcare payment model in a healthcare setting. Many health insurance companies will not pay for phone consultations that social workers conduct for case management services with patients. A National Academies of Sciences, Engineering, and Medicine 2019 report, Integrating Social Care into the Delivery of Health Care, identified 5 key financial challenges impacting the integration of social services and healthcare including:

- Legal definitions of healthcare, which drive what is covered by health insurers

- Healthcare payment models that lack necessary incentives

- Uncertain accountability

- Fragmented financing for dually eligible Medicare and Medicaid beneficiaries

- A lack of administrative capacity for social service providers

The report also shares a framework for 5 activities for healthcare systems that have been used successfully to strengthen communication and coordination between the social services and healthcare sectors. These activities include awareness, adjustment, assistance, alignment, and advocacy with activities that target both individuals and the community to improve integration.

The Commonwealth Foundation's report, Care Management for Medicaid Enrollees through Community Health Teams, notes that one potential solution is to create community health teams or networks and medical homes that are financially supported through a single payer, such as Medicaid, or by multiple payers that could include commercial insurers, Medicare, and Medicaid.

Another significant barrier to integrating human services with healthcare in rural areas is having human service programs and operating staff available to coordinate with the healthcare system. Since rural human services providers often lack adequate resources, it may be difficult for them to provide needed services in a community, regardless of the setting. As the RUPRI Human Services Panel states in their report, Rethinking Rural Human Service Delivery in Challenging Times: The Case for Service Integration, sometimes even services deemed essential are unavailable or nonexistent.

Other challenges include:

- Compliance with federal and state laws and regulations

- Navigating privacy laws to allow data sharing without compromising confidentiality

- Mitigating liability

- Availability of transportation

- Stigma associated with receiving services

- Lack of infrastructure or technology

- Community members' lack of awareness of available services and programs

- Lack of local revenue to financially support services and programs

- Balancing and coordinating different organizational structures

The Rural Services Integration Toolkit offers further discussion on barriers and implementation challenges that may occur with rural services integration and describes potential solutions to address these challenges. For more information on payment structures and policies related to rural healthcare services, see our Rural Healthcare Payment and Reimbursement topic guide.

Where can I find information about the different ways human services can be integrated within a rural healthcare organization?

The human services system interacts with the healthcare system in many ways, from healthcare provider referrals to a human services provider to creating new programs involving physicians, human services providers, and community organizations to address unmet needs in a community such as housing, transportation, access to healthy food, and more. A RUPRI Rural Human Service Panel report discusses common themes and characteristics for 5 case studies that showed innovative and non-conventional approaches of integrating health and human services projects in rural areas. To learn more about the different services integrations models and how they can be integrated, see the Rural Services Integration Toolkit.

What human services may be available to rural residents who are affected by the opioid crisis?

In October of 2017, the U.S. Department of Health and Human Services declared the opioid crisis to be a nationwide public health emergency. This emergency declaration requires attention not only from healthcare providers and systems, but also from organizations providing human services that have made many resources available at the local and national level.

The Rural Community Toolbox has a Treatment and Services for Individuals page that features programs and resources from across the federal government that can help rural communities address opioid and other substance use.

To learn more about initiatives targeting opioids in rural areas and resources rural communities and organizations can use to address opioid misuse, see our Rural Response to the Opioid Crisis topic guide. For a more in-depth review of how substance misuse, including opioids, impacts health in rural communities, see the Substance Use and Misuse in Rural Areas topic guide.